Holding up against stiff headwinds

Last year, the reopening of the economy, new vaccines, strong profit growth and low interest rates fueled big gains in stocks.

By December 31, 2021, the broad-based S&P 500 Index, which is comprised of 500 large publicly traded U.S. companies, had more than doubled from its late March 2020 bottom, according to data provided by the St. Louis Federal Reserve.

The bull market was just 449 trading-days old, and the S&P 500 Index had advanced 113%. In fact, when we compare the current bull market to the six best performing bull markets since the end of World War II (through the first 449 days), the current run easily exceeded its contenders.

But the winds have shifted in 2022.

Inflation is a growing problem, oil and gasoline prices are up sharply, investors are grappling with the fallout of Russia’s invasion of Ukraine, and the Federal Reserve has pivoted away from its easy money policy.

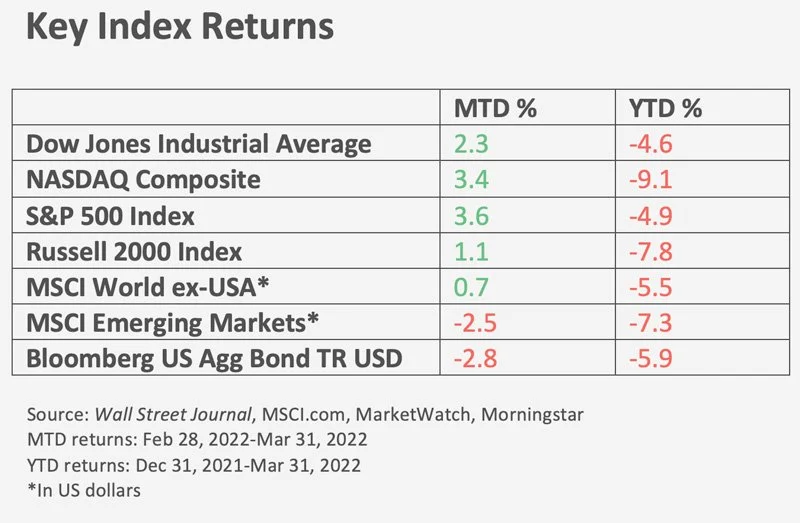

Yet, as the table of returns below illustrates, the major averages have been quite resilient in the face of stiff headwinds. Credit the economic expansion and rising corporate profits. It’s not completely counterbalancing the negativity, but it has cushioned the downside.

Stocks don’t move higher in a straight line. Volatility and corrections are to be expected, as we’ve discussed before.

Still, heightened uncertainty is rarely cause for celebration, even if losses have been relatively modest.

We don’t try to forecast when markets might correct. Instead, we make recommendations and individually craft portfolios based on several factors, including the idea that we will run into unexpected detours along the way.

Pullbacks are a normal part of investing. They are sparked by unexpected events. We will usually experience several corrections over the course of an economic expansion. But history says they are temporary.

While uncertainty generated by geopolitical events have rarely caused long-term damage to the major market indexes, they do create short-term volatility.

You see, the initial news of an event usually generates heightened uncertainty, which forces short-term traders to pull back. But if the crisis does not affect U.S. economic activity, investors typically incorporate the new normal into their outlook.

Let’s look at Ukraine. It’s fair to say this isn’t your typical geopolitical event. But so far, it seems to be following the historical pattern.

But let’s acknowledge the obvious. What is happening in Ukraine is far from ideal, and how the war may unfold is a big unknown. Recently, there have been no significant developments that might negatively affect investor sentiment, and investors seem to be taking the apparent stalemate in stride.

It’s not that we are immune to the horrific acts of aggression by Russia. We’re not. But investors look at geopolitical affairs through a very narrow prism. That is, how will an event or events impact the economy?

Few see a cessation of hostilities in the near term. However, investors may slowly be growing accustomed to the daily reports coming out of Ukraine. It’s as if we are becoming comfortably uncomfortable with the war.

Put another way, investors seem to slowly be incorporating a new normal into their collective outlook, as there hasn’t been a significant shock to demand for goods and services at home.

But, you may ask, what about oil prices? What about the surge in gasoline prices? For starters, it’s painful every time we fill up. And it will translate into higher inflation.

But the broader economic impact is less certain. For every penny increase in the price of gasoline, U.S. consumer spending drops by $1.18 billion a year, according to an estimate from Federated Global Investment Management (Bloomberg).

For example, a $0.75 jump in gasoline, if maintained over a year, would hit spending by roughly $90 billion. But U.S. Gross Domestic Product is over $24 trillion, which would translate to less than 0.4% of GDP. It’s not insignificant, but by itself, it’s not enough to throw the economy into a recession.

Then there is the Federal Reserve. Its commentary has grown increasingly aggressive as it hopes to rein in inflation.

At the March meeting, the Federal Reserve raised the fed funds rate by one-quarter of a percent to 0.25%–0.50%. Its own Summary of Economic Projections suggests we may see a fed funds rate of 1.75%–2.00% by year end. And, as Fed Chief Powell has said, don’t discount the possibility of at least a half-percentage point rate hike (or hikes) at upcoming meetings.

Why is all of this important?

For savers who want safe, interest-bearing investments it’s good news.

For equity investors, it’s more problematic. When bond yields and interest rates are low, they offer little competition to stocks. But rising rates and yields could encourage some investors to look at alternatives outside of equities.

From an economic perspective, some are asking if the Fed can bring inflation back down without causing a recession.

In past cycles, rate hikes were pre-emptive and proactively implemented to stave off any future jump in inflation. The Fed succeeded in engineering what’s called a soft landing in the mid-1980s and mid-1990s.

Today, the Fed is reacting to higher inflation. It creates economic uncertainties that we will carefully monitor throughout the year.

we’re here to help

I trust you’ve found this review to be educational and helpful. If you have any questions or would like to discuss any matters, please feel free to give me or any of my team members a call.

As always, I’m honored and humbled that you have given me the opportunity to serve as your Life-Centered Planner.